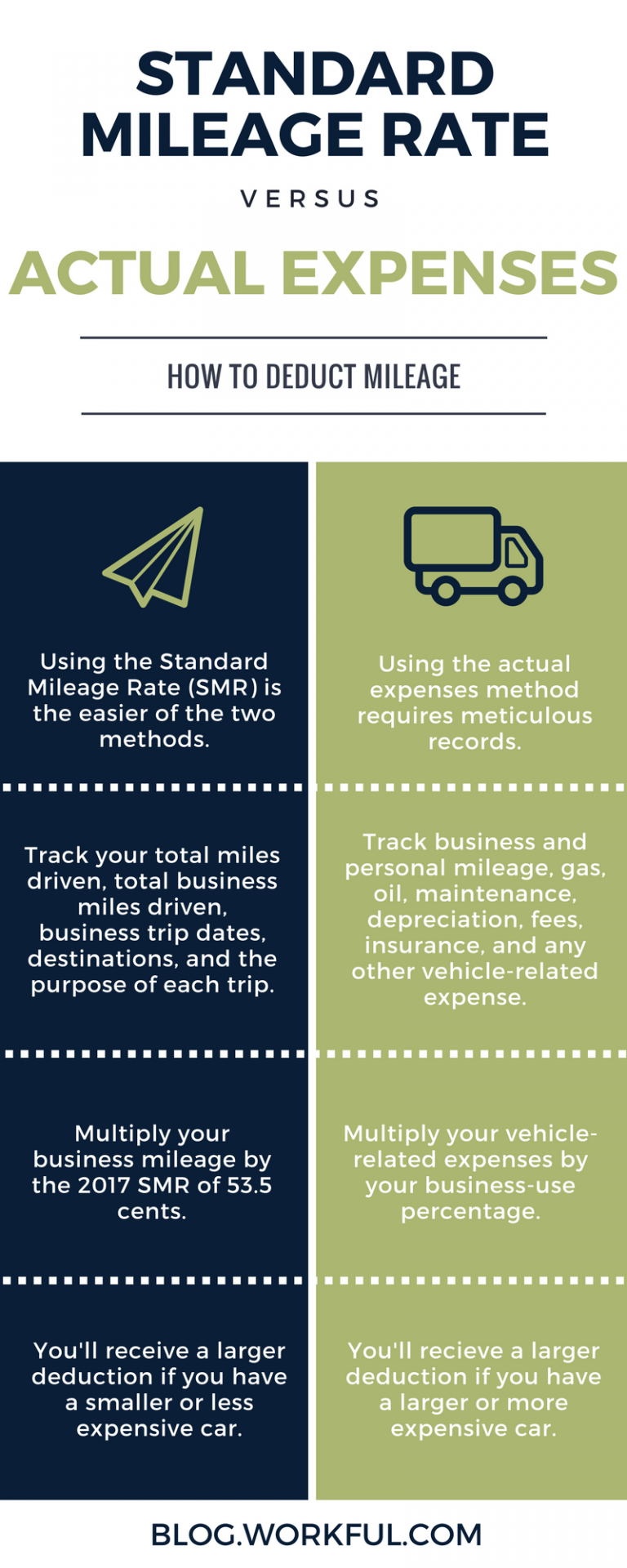

Standard Mileage Deduction 2025 - How to Deduct Mileage Standard Mileage Rate vs. Actual Expenses, For 2025, the standard mileage. Moving ( military only ): Mileage Tax Deduction Rules 2025, 67 cents per mile driven for business use (up 1.5 cents. The irs allows you to deduct a standard mileage rate from your earnings to lower your taxable income.

How to Deduct Mileage Standard Mileage Rate vs. Actual Expenses, For 2025, the standard mileage. Moving ( military only ):

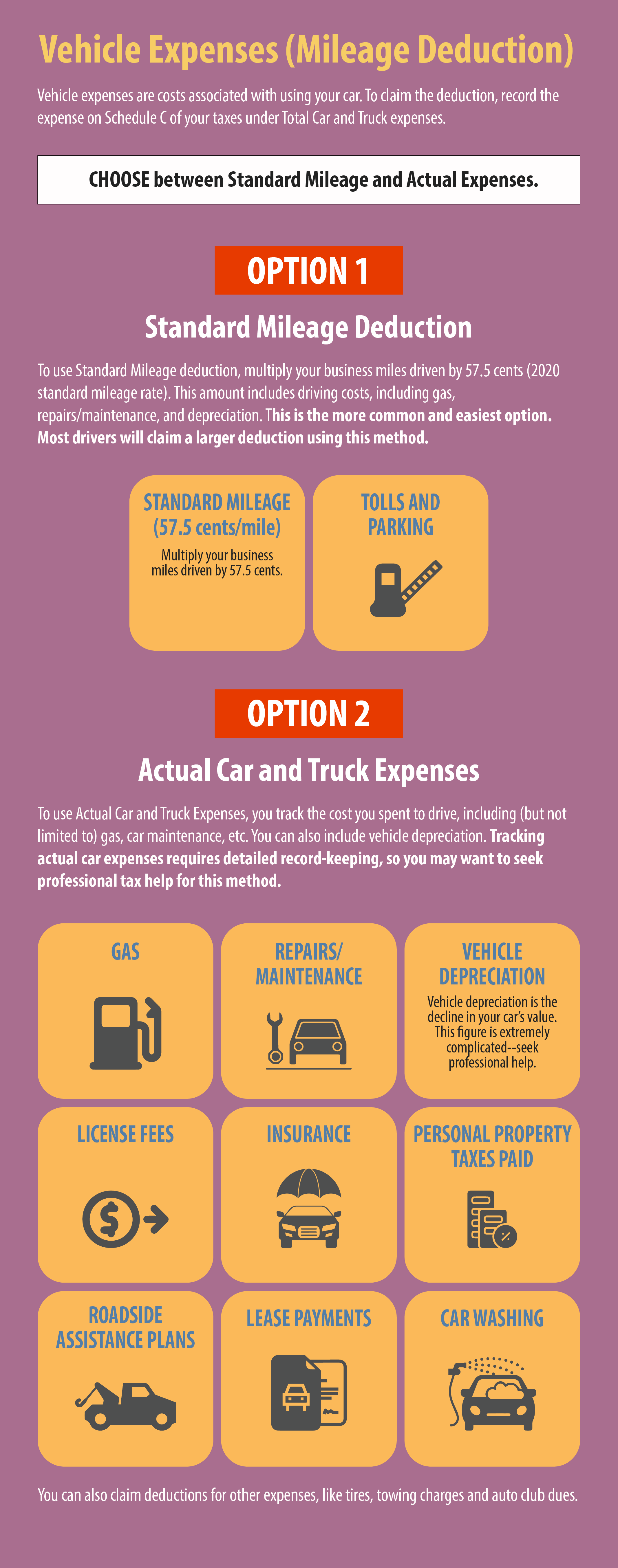

How to Claim the Standard Mileage Deduction Get It Back Tax Credits, The new rate kicks in beginning jan. The new irs mileage rates for 2025 are 67 cents per mile for business purposes (up from 65.5 cents per mile in 2023), 21 cents per mile for medical or moving.

IRS Announces 2025 Tax Brackets Standard Deductions And Other Inflation, For 2025, the standard mileage. Learn about the mileage tax deductions, business mileage reimbursement, how to claim a mileage deduction, and see the 2025 irs mileage rate with help from h&r block.

You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving.

Important Update on 2025 Standard Mileage Rates and Deductions Bailey, Beginning on january 1, 2025, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) are: The standard mileage deduction is simple.

The irs allows you to deduct a standard mileage rate from your earnings to lower your taxable income.

2025 Itemized Deductions Form Becka Klarika, The irs allows you to deduct a standard mileage rate from your earnings to lower your taxable income. This notice provides the optional 2025 standard mileage rates for taxpayers to use in computing the deductible costs of operating an automobile for business,.

You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving. The new irs mileage rates for 2025 are 67 cents per mile for business purposes (up from 65.5 cents per mile in 2023), 21 cents per mile for medical or moving.

New Standard Deductions for 2025 Taxes Marketplace Homes Press Release, The 2025 standard mileage rate is 67 cents per mile, up from 65.5 cents per mile last year. The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing.

Standard Mileage Deduction 2025. 1, 2025, the standard mileage rates for the use of a car, van, pickup or panel truck will be: All you have to do is keep a record of how much you drive in a year for business and then.

How to Easily Deduct Mileage on Your Taxes, The 2025 medical or moving rate is 21 cents per mile, down from 22 cents per mile last. All you have to do is keep a record of how much you drive in a year for business and then.